By Attorney Curtis A. Edwards

In a progressive move to modernize the legal process of executing estate planning documents, on March 21, 2024, Governor Tony Evers signed into law SB 898 (Wisconsin Act 130), which establishes a procedure for the remote notarization and/or witnessing of estate planning documents.

While remote notarization of other types of documents has been possible under Wisconsin law since 2020, estate planning documents have been an exception due to the need for more stringent protocols. The new legislation marks a significant shift in how individuals can legally execute crucial estate planning documents, ensuring accessibility and convenience while upholding the integrity of the law and the documents being executed.

The new legislation encompasses a wide array of estate planning documents, including wills, trusts, powers of attorney, health care directives, and marital property agreements. The comprehensive nature of the law demonstrates the state’s commitment to facilitating essential legal transactions in an increasingly digital world.

Under the new law, remote notarial acts relating to estate planning documents must adhere to stringent procedures outlined in section 140.147 of the Wisconsin Statutes. Unlike other remote notarization processes, estate planning documents necessitate supervision by a Wisconsin-licensed attorney in good standing. This provision ensures that legal oversight is maintained throughout the remote execution process, safeguarding against potential fraud or misconduct.

Crucially, the use of audiovisual communication technology is mandated to enable real-time interaction between the notary, supervising attorney, remotely located individual, and any witnesses. This ensures transparency and accountability, mirroring the traditional in-person notarization process while leveraging technological advancements for greater efficiency and access.

Additionally, remote notarization of estate planning documents requires confirmation of the signer’s physical presence in Wisconsin, along with stringent identity verification measures. These include personal knowledge or production of government-issued credentials to authenticate the signer’s identity and location.

During the remote signing process, individuals must declare their understanding and voluntary execution of the document, and the document must specifically reference that it is being executed pursuant to section 140.147 of the Wisconsin Statutes. Upon completion, the notarized document is forwarded to the supervising attorney for retention and archiving, ensuring a record of the document is made.

The legislation further mandates the completion of an affidavit of compliance by the supervising attorney, affirming adherence to the statutory requirements. This affidavit serves as a crucial record of due diligence, providing additional assurance of the document’s validity and legality.

Overall, SB 898 represents a significant step forward in modernizing legal practices in Wisconsin, providing individuals with greater flexibility and accessibility in executing vital estate planning documents. By embracing remote notarization, the state reaffirms its commitment to innovation while upholding the highest standards of legal integrity and protecting against fraud and misconduct.

If you have any questions or are interested in learning more about this topic, please contact Lin Law LLC at (920) 393-1190.

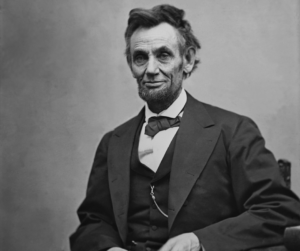

Act empowers married individuals to customize the disposition of their assets during their life and after death through marital property agreements. One such provision that can significantly impact estate planning is the “Washington Will” provision, so named because of its origin and use in Washington State. This provision allows a married couple to seamlessly transfer assets upon death without the need for probate, simply by providing so in their marital property agreement.

Act empowers married individuals to customize the disposition of their assets during their life and after death through marital property agreements. One such provision that can significantly impact estate planning is the “Washington Will” provision, so named because of its origin and use in Washington State. This provision allows a married couple to seamlessly transfer assets upon death without the need for probate, simply by providing so in their marital property agreement. A. Edwards, J.D.

A. Edwards, J.D.

A. Edwards

A. Edwards