Did you ever wonder what the difference is between a Sole Proprietorship and a Limited Liability Company (LLC)? Whether you want to start a side hustle or grow your small business, determining which structure you need is the best first step. The two most common forms of business are a Sole Proprietorship and an LLC. Both allow you to function as a working business, but they differ when it comes down to credibility, liabilities, and taxes.

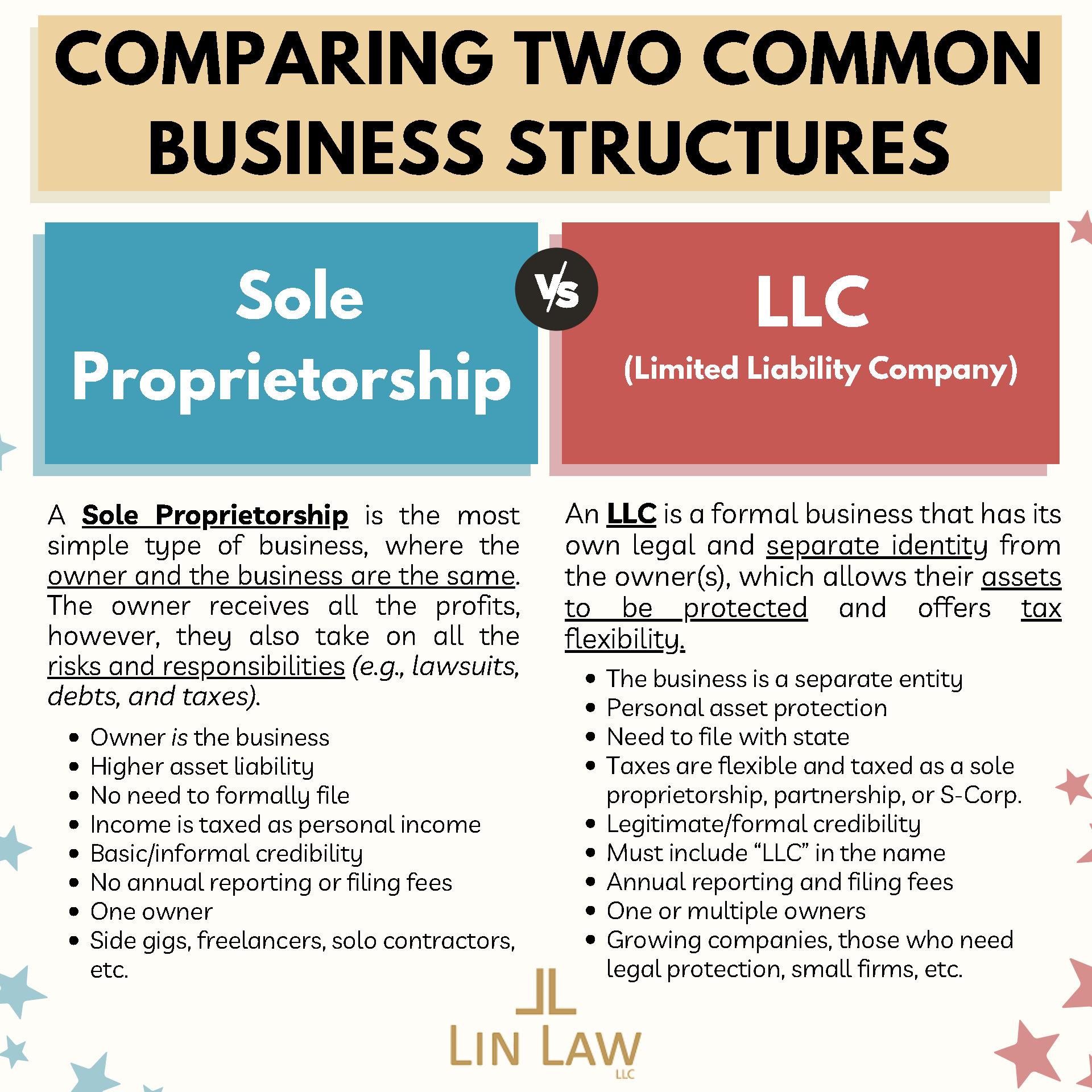

A Sole Proprietorship is the simplest form of business where the owner and the business are legally the same. This means the owner will directly receive all of the profits as personal income. However, this carries a lot of liability to the owner’s personal assets. Going further, an LLC is a step up in formality and credibility from a Sole Proprietorship. In this structure, the owner and the business are legally separate, which provides protection over the owner’s personal assets while also offering tax flexibility and greater options for growing businesses with multiple owners.

Review your business direction and goals. Are you wanting to test a new idea? Have you been wanting to expand in the community? Do you want to hire more employees? The foundation your business starts on is crucial to its later success, and that can be grown from choosing the right type of business model.

Let the right business structure carry you forward!

#BusinessStructure #LLCvSoleProp #WisconsinBusiness #AssetProtection #StartSmart #LinLawLLC #SmallBusinessTips #LegalPlanning #Entrepreneurship