Do you know the difference between a revocable and irrevocable trust? Both allow you to avoid probate; however, they serve different purposes when it comes to privacy, protection, and control.

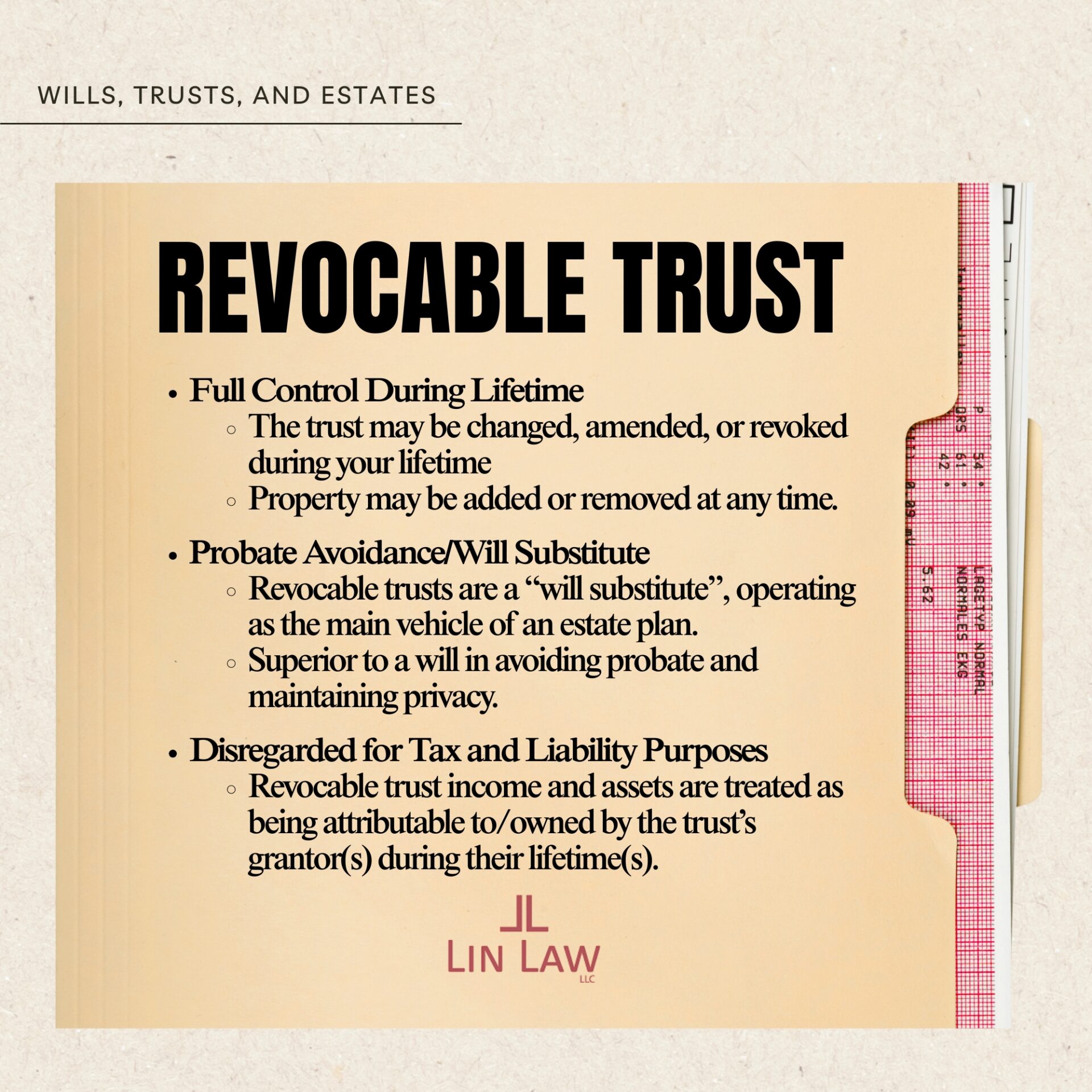

A revocable trust, also called “living” trust, offers greater flexibility, letting you edit at any time and still have control over your assets. However, having control does not mean it provides asset protection or any tax benefits.

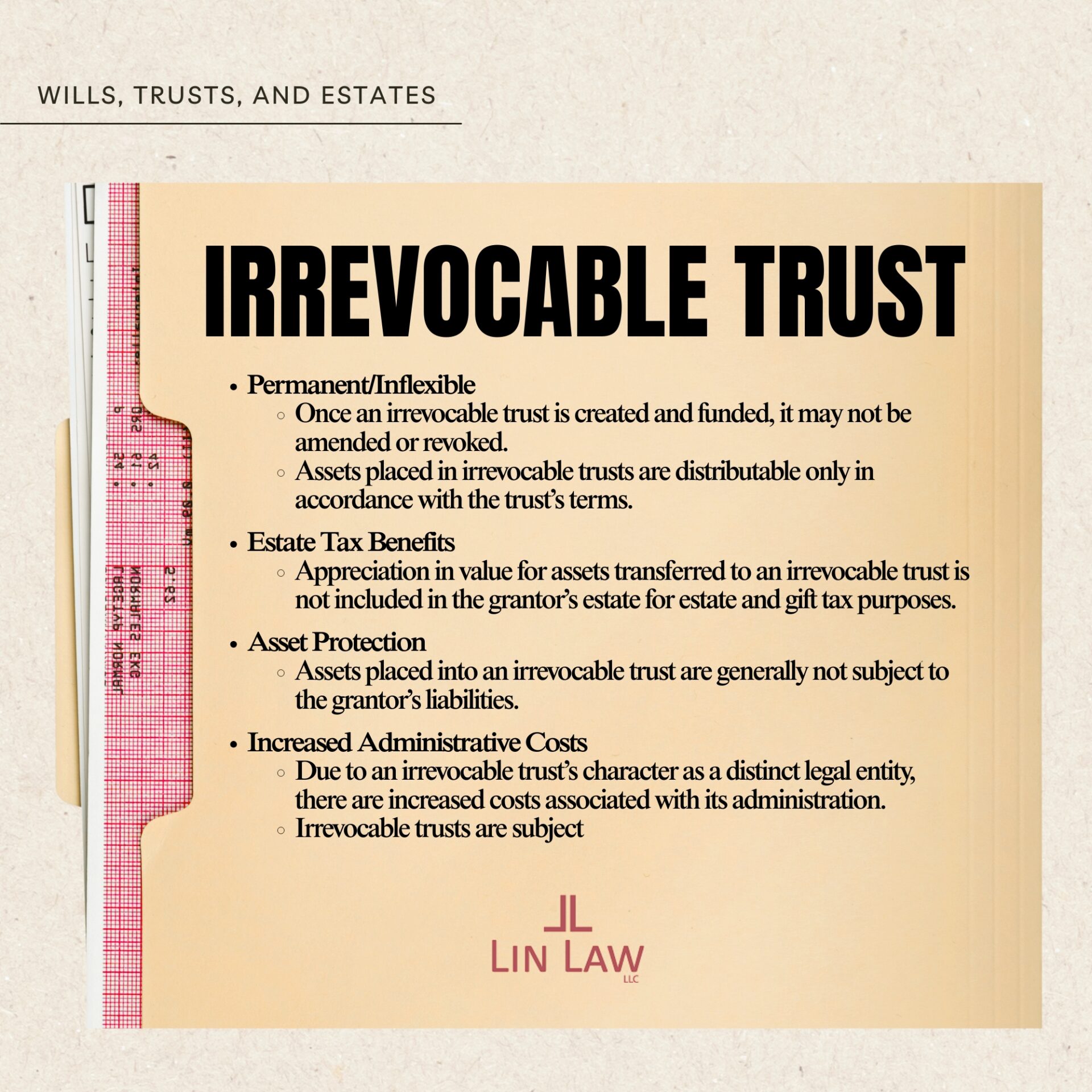

On the other hand, an irrevocable trust is much stricter. Once you transfer your assets into it, they are now locked in the trust. Even if you lose some asset control, you gain greater asset protection from creditors and may receive tax advantages.

Before you choose, sit down and discuss your estate planning goals. What is most important to you: control during your lifetime or security in long-term protection?