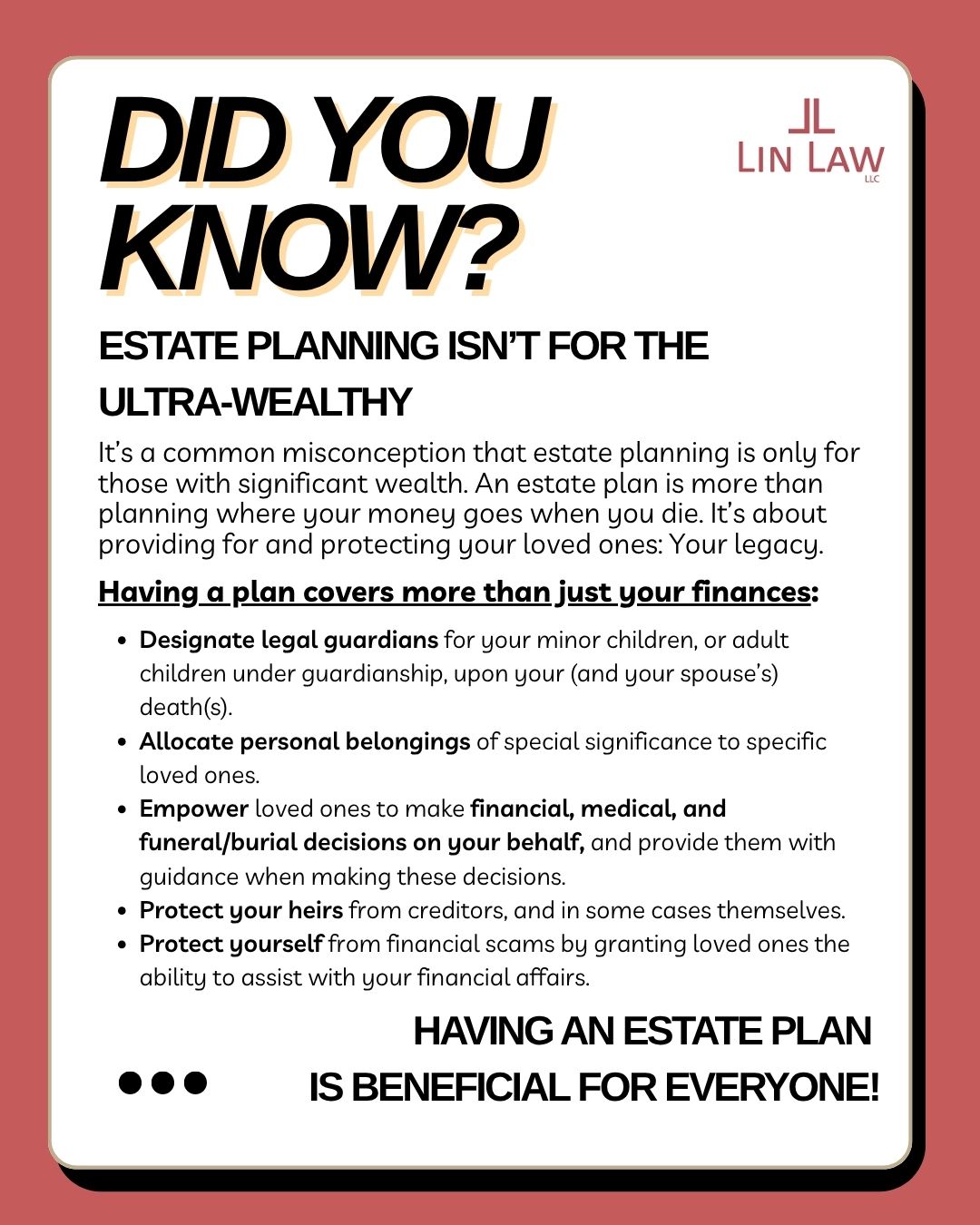

An estate plan doesn’t only deal with allocating and distributing your wealth after you die. In an estate plan, you can:

1. Designate legal guardians for your minor children (and adult children under guardianship), upon your (and your spouse’s) death(s), to ensure your children are cared for by the loved one of your choosing. This can be done either in a will-based or a trust-based estate plan.

2. If you have personal belongings of special significance, whether family heirlooms or any other items of sentimental value, you can utilize a memorandum disposing of tangible personal property (in conjunction with a will or trust) to pass those items to specific loved ones, even if they are not your heirs.

3. Under powers of attorney for finances, health care, living wills, and authorizations for final disposition, you can empower loved ones to make financial, medical, and funeral/burial decisions on your behalf, and you can specify guidelines and/or your specific desires in certain situations.

4. You can protect your heirs by establishing separate asset protection trusts for their benefit, which can protect their inheritance from creditors and, if necessary, themselves (including if your heir has substance abuse, gambling, or other personal issues). This can be accomplished either using a will-based of trust-based estate plan.

5. You can protect yourself from increasingly more common financial scams targeting elderly individuals, by granting a trusted loved one the ability to supervise and assist with managing your financial affairs in a power of attorney for finances. Granting supervisory authority to a loved one is not bulletproof, but it does lessen the chance that a financial scam persists unchecked.

Your legacy is more than just your wealth, it is how your loved ones remember you and the impact you have on their lives. Use an estate plan to protect your legacy.