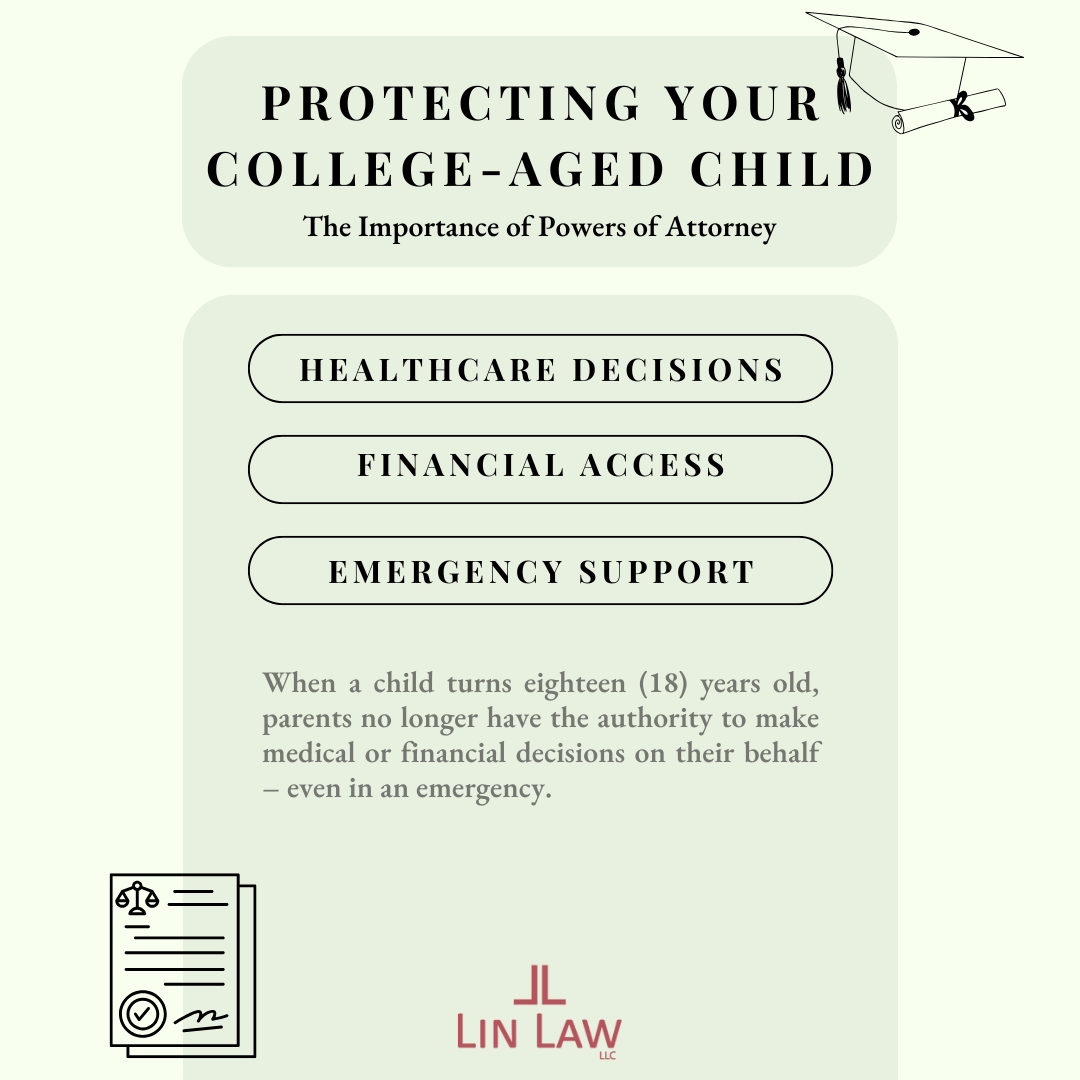

With high school graduations just around the corner, it’s a great time of year to take stock of just how much changes when our children turn eighteen. Whether you have a child preparing to head off to college for the first time, enter the workforce, or coming home for the summer, they are considered adults upon turning eighteen years of age. As their parents, you are no longer able to access or assist with their medical or financial decisions without the proper documents in place. A Healthcare Power of Attorney (and HIPPAA release) and Durable Power of Attorney allows your child to legally appoint you as their health care and financial agents. This enables you to step in on their behalf – whether it’s to speak with doctors about medical decisions/appointments or assisting with tuition payments, banking and other personal financial matters. Having these documents executed can make all the difference when it matters most, providing the ability to act quickly in an emergency situation and offering peace of mind especially when your child is away at school and/or traveling.