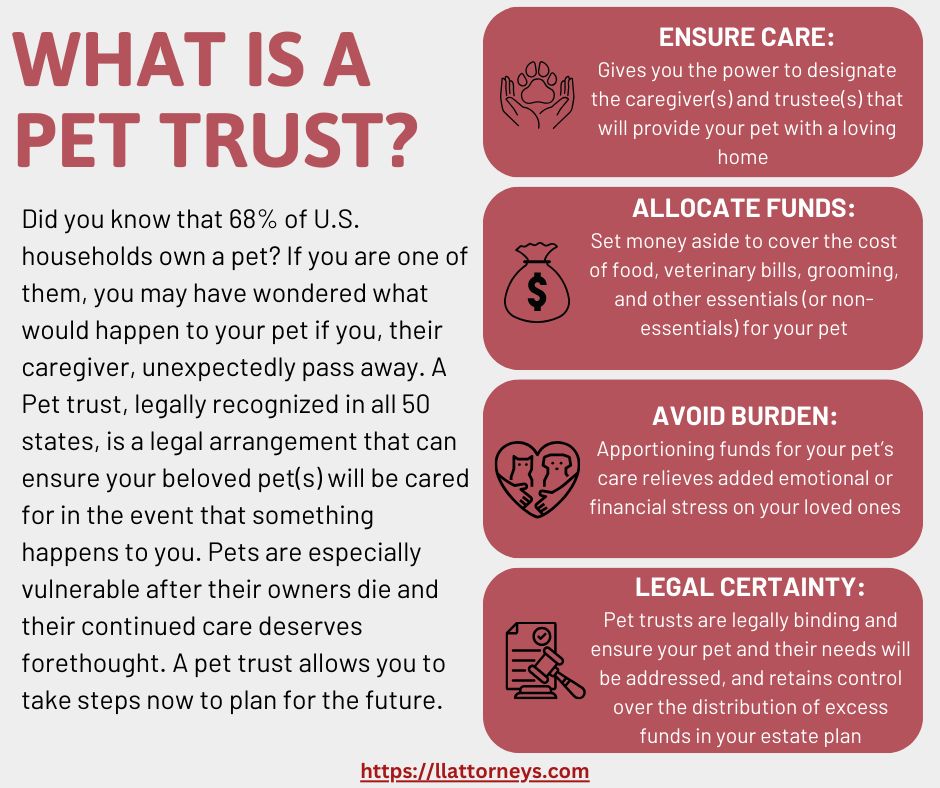

Yes, a pet trust is really a thing. For many, pets are as much a part of the family as you or I. They may not be able to say so, but they deserve a plan, too. Pet trusts are legally binding arrangements that ensure your pet(s) are cared for, according to your wishes, if you are unable to do so due to illness, disability, or passing away. Similar to a trust with human beneficiaries, it allows you to set funds aside specifically for your pet’s needs, appoint one or more trustees to manage the trust’s assets, designate one or more caregivers for your pets, and give detailed instructions for their care. If necessary or desired, you can also compensate the caregiver for your pet’s care. If there are any funds leftover after your pet’s death, you decide who will receive those funds, whether it be your pet’s caregiver, divided among your family or other beneficiaries, or to a charity of your choosing. Pet trusts can provide people with a peace of mind and a sense of certainty that their pet is accounted for and a plan is in place to meet their needs. A pet trust ensures that your beloved companions would continue to receive the love and care that they are used to, no matter what.